Explained: Investing in Coins (Part 2)

Investing in coins can be quite a different game depending where you are in the world. This blog seems to cater to the Sub continental reader, so I will tailor this article to him or her.

The subcontinental reader seems to suffer from a lack of access to eBay or at least easy access to western eBay. eBay has a number of benefits and drawbacks.

Something like 70% of my purchases come from eBay, so I think it pertinent to include information on this type of purchase. There are a number of reasons for this.

There are different forms of collecting, most elite collectors use a model that sees them selling around 25% of their collection annually in order to correct the inevitable mistake purchases, benefit from value generating sale opportunities or raise money for sensible purchases.

Below is a diagram of the model

The modern form of selling online carries with it a cost equivalent to the old forms, like coin shops or auctions, with shops and auctions one is forfeiting a price.

This said if I say that I acquire 70% of my stock on eBay that means that due to the 10% charge I am losing £1 in £10 over 70% of the collection. Buying from shops or auctions you will lose more, buying from Facebook or boot sales and street markets you will lose less.

Precious metal and numismatic value

Coins, bullion bars even some old trinkets have two forms of value, the weight in precious metal and the numismatic value.

The precious metal value is essentially the price someone is willing to pay you for the coin because of its metal value on the global marketplace, usually with the aim of selling it in bulk to other investors.

The other type of value is the value of the coin, bullion bar or trinket because of its collecting value. So in theory a one ounce silver coin might be worth $80 rather than the current spot price of $17 because it comes in the form of commemorative collector’s edition.

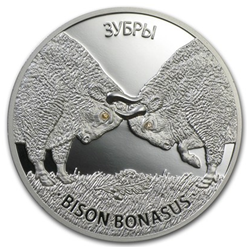

The coin above is from Belarus, it has a lovely duelling Bison engraving. Some sort of gem set in the eyes and a low mintage of only 4,000 pieces. So I am one of only 4,000 people in the world to own one.

Governments around the world including ironically Communist countries like China make money from issuing commemorative coins. The price of these depends on:

- The mintage. Check on Numista.

- The year of issue for example in China a collector might want a coin from a ‘lucky year’ and be willing to pay more.

- The aesthetics of the design relative to artistic tastes.

- The availability of a coin in a certain area. For example people from Eastern Europe benefit greatly by buying Russian coins and then selling them in Europe on eBay. This works specially for sports commemorations like Sochi etc. I remember paying £9.95 each for two Sochi 100R banknotes from the Ukraine, the person will have made something like £7 on that trade. I sold one myself for £12, still a profit, so I got the banknote for £7.95

So when one is considering a purchase there are a few main considerations.

- Can I sell this coin?

- Where can I sell it, am I selling in the optimum place?

- How long does the trade take, do I have to go out of my way to visit a shop or attend an auction?

- How much am I getting this for? If I am buying for myself can I buy more than one and sell the rest to reduce the cost of my original purchase? This will depend on the sale-ability.

- Am I getting anything extra, some coins come with a folder, is the folder there? If not can I get one with the folder for the same price?

- Is this coin real?

One is always better trying to reduce the number of one’s trades by increasing the value, this means you can avoid the hassle and cost of dealing with large numbers of buyers.

This is called condensing or streamlining, it may not suit everyone.

It is quite reasonable to sell a lot of low value coins as long as you have a decent relatively low cost method of doing so. Something I generated quite a bit of value from at a time was getting British silver bullion coins and swapping it with people.

What you do is go to sites like this one where you can buy the coins cheaply in bulk and then swap or sell them to generate profit or value.

Each of those maple leaf rounds cost £14 at the moment but a lot of people think they cost around £20 so you can maybe get £18 in value from them. That is a profit of £4 each, over 25 coins that is £100, enough to buy another 7 coins.

The toolkit

A numismatic investor should have a toolkit. This should include:

- A good quality magnifying glass.

- If appropriate recent reference books, this is useful for finding approximate value, listing adverts and marketing your sale.

- A camera and perhaps a light box to set your coin in for photographs, constructed from an electric light and white PVC plastic, fiberglass or laminated wood.

- You will need a set of scales, a small electronic set, like the ones that drug dealers use. You should weight every coin to make sure it is the weight it is supposed to be as listed.

- A magnet, this will pick up on older fakes.

- A sharp knife, bare in mind some sellers might include low value bank notes as a gift so don’t rip open packages.

Provided by Mr. Alan Gingelos

Comments

Post a Comment